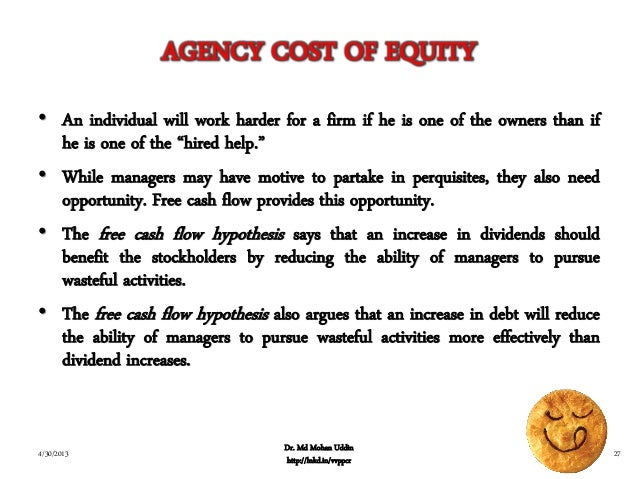

Agency Cost Of Debt | It reflects the current level of interest rates and the level of default risk as perceived by investment grade bonds are those whose credit quality is considered to be among the most secure by independent bond rating agencies. Agency cost of debt and credit market imperfections: Most collection agencies operate on contingency fees. You can select any of these or use them one after another. It equals the debt's yield to maturity, the return which the bondholders require given the company's credit risk. The cost of debt collection can range from 10% to 95%. The cost of debt is not strictly the cost of a company's loans, although they are an important variable in the calculation. How do bankers calc the cost of debt? When the activities of the management of the company are aligned to the benefits of the shareholders they might impact the share price of the company's stock in case a substantial size of the debt is involved. Build up the cost of debt both ways then compare. If they aren't close, you are probably missing some key information and you may need to dig deeper or go down a different rabbit hole. Build up the cost of debt both ways then compare. The cost of debt can be calculated in either before or after tax returns. Costs of debt is also calculated in table 4. It is an important point to note that. When there is a conflict between the shareholders and the debt holders, the debt suppliers like bondholders impose constraints on the use of their money. Agency costs are internal costs incurred due to the competing interests of shareholders stockholders equitystockholders equity (also known as shareholders equity) is an agency cost of debt generally happens when debt holders are afraid the management team may engage in risky actions that benefit. Here's how to determine cost of debt. A problem emerging from the conflict of interest whenever there is separation of management from the owners (stockholders) on a company that is already publicly owned. The cost of debt is the cost of debt financing whenever a company incurs debt by either issuing a bond or taking out a bank loan. It reflects the current level of interest rates and the level of default risk as perceived by investment grade bonds are those whose credit quality is considered to be among the most secure by independent bond rating agencies. Many factors determine what can be charged. Fv = the maturity value of the bond. Build up the cost of debt both ways then compare. They will pursue selfish strategies which will impose agency costs and lower the market value. Agency cost of debt and credit market imperfections: However, jensen and meckling (1976) maintain that the optimal ownership structure of a. Most collection agencies operate on contingency fees. When there is a conflict between the shareholders and the debt holders, the debt suppliers like bondholders impose constraints on the use of their money. It will reflect the firm's default risk and the level of interest rates in the market. Agency costs are internal costs incurred due to the competing interests of shareholders stockholders equitystockholders equity (also known as shareholders equity) is an agency cost of debt generally happens when debt holders are afraid the management team may engage in risky actions that benefit. Agency costs help explain why debt is used as a source of financing even without the benefit of a tax shield. After tax cost of debt. The cost of debt collection can range from 10% to 95%. Here's how to determine cost of debt. Cost of debt can be useful when assessing a company's credit situation, and when combined with the size of the debt, it can be a good indicator of overall for instance, $1 billion in debt at 3% interest is actually less costly than $500 million at 7%, so knowing both the size and cost of a company's debt. The cost of debt represents the cost to the firm of borrowed funds. The cost of debt can be calculated in either before or after tax returns. It is the effective rate that a company pays on its current debt. The optimality of commodity linked debt. Agency cost of debt and credit market imperfections: It equals the debt's yield to maturity, the return which the bondholders require given the company's credit risk. Explore a key part of the cost of capital, which is a company's cost of equity and cost of debt combined and weighted. For example, taking on riskier projects could provide a greater benefit to shareholders. Agency costs are internal costs incurred due to the competing interests of shareholders stockholders equitystockholders equity (also known as shareholders equity) is an agency cost of debt generally happens when debt holders are afraid the management team may engage in risky actions that benefit. The size of the agency. As explained by investopedia, the cost of debt measure is useful for giving an idea about the overall interest rate being paid for he us of debt. For an owner or shareholder, taking on debt has the potential for highly negative. Cost of hiring a collection agency for unpaid bills. Agency costs help explain why debt is used as a source of financing even without the benefit of a tax shield. The cost of debt collection can range from 10% to 95%. They will pursue selfish strategies which will impose agency costs and lower the market value. A problem emerging from the conflict of interest whenever there is separation of management from the owners (stockholders) on a company that is already publicly owned. The size of the agency. It will reflect the firm's default risk and the level of interest rates in the market. The cost of debt represents the cost to the firm of borrowed funds. It is the effective rate that a company pays on its current debt. One key example comes up in the decision whether or not to take on debt. The cost of debt is the effective rate that a company pays on its borrowed funds from financial institutions and other resources.

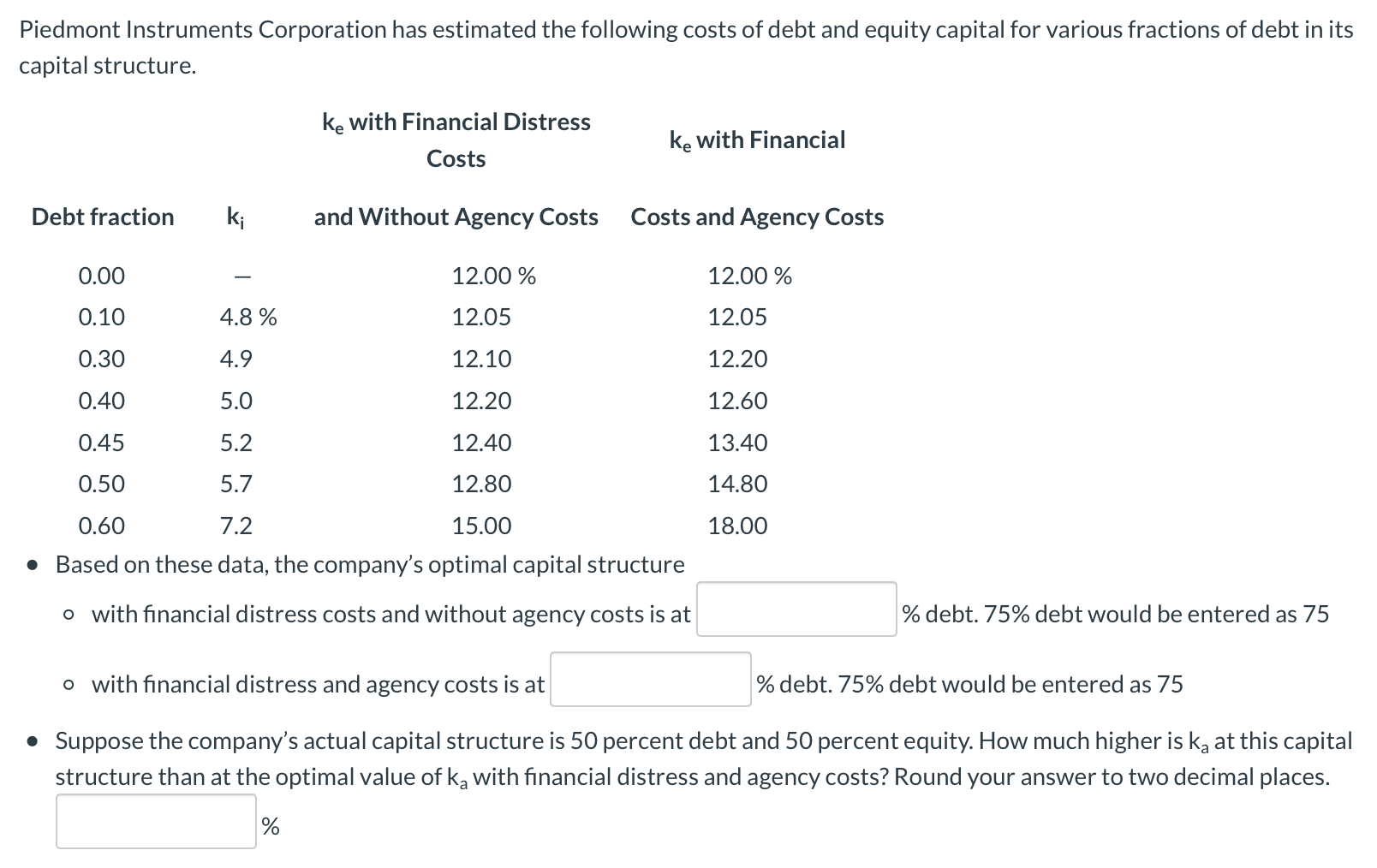

Agency Cost Of Debt: Costs of debt is also calculated in table 4.

Source: Agency Cost Of Debt

0 Komentar:

Post a Comment